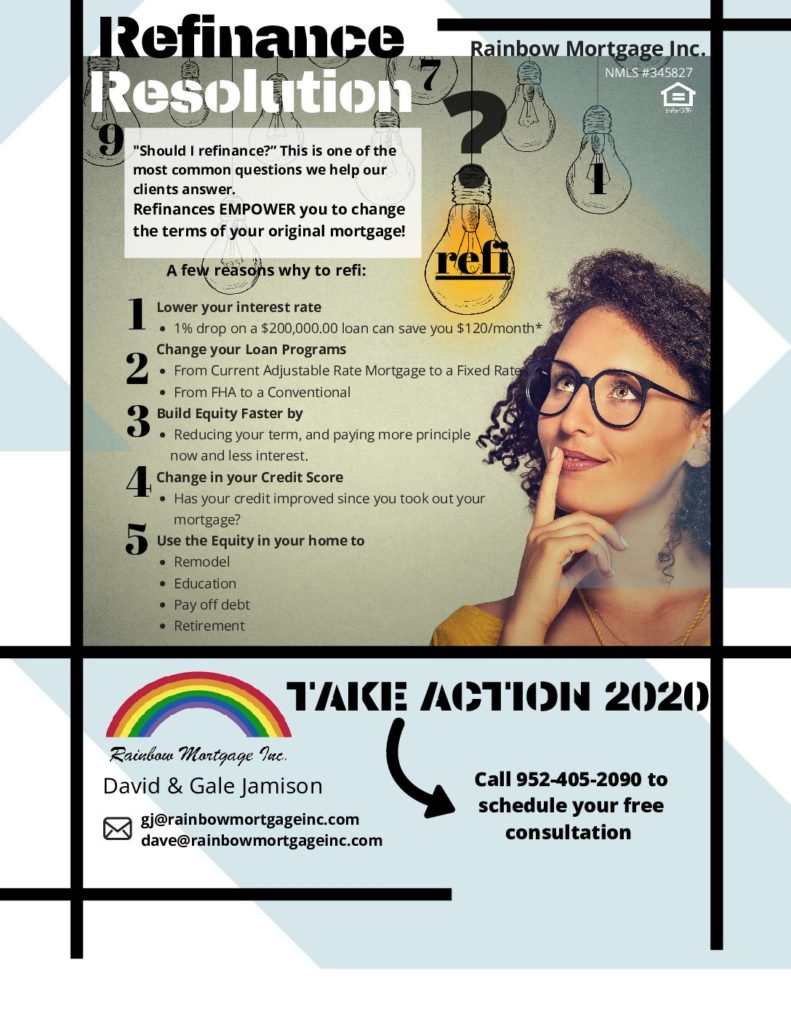

5 reasons to refinance

“Should I refinance my mortgage?”

This is one of the most common questions we help our clients answer.

When you refinance your existing mortgage, you are essentially paying off the existing mortgage debt and replacing it with a new loan. Many of the same costs are involved in refinancing a loan as are in first−time financing.

There is an old adage in the mortgage business that states that if you can improve your interest rate by at least two percentage points, then it is a good time to refinance. While that may work as a general rule of thumb, the truth is that there are many reasons to refinance. Here are the top five we see.

1. Lower Interest Rate

Securing a lower interest rate is one of the top reasons for refinancing. A lower rate can make a large different in your monthly payments, and save you money on the financing fees!

2. Build Equity Faster

If you’re in a position to make a higher monthly payment due to a salary increase or other good fortune, you may want to refinance from a 30-year loan to a short (15 or 20 year) term loan. Adjusting the term enables you to build equity faster and save a large amount of money on the interest paid over time!

3. Change your Loan Program

Some homeowners who start in an ARM (Adjustable Rate Mortgage) discover they’d rather switch to a more stable Fixed Rate mortgage. While an ARM may have been the more attractive loan program when you first purchased, we can compare different Fixed Rate programs to find which would save you more money.

4. Credit Score Improvement

If you’ve increased your credit score since you first applied, you may be in position to refinance with a lower rate with your higher score! We’ll evaluate your current loan, then compare the rates with your new score to find you the best program that’ll lower your monthly payments!

5. Getting Cash Out

With a Cash Out Refi you’re able to tap into the equity that you’ve built in your home. You may want to put money towards home improvements, send a child to school, or pay off other debt with the equity you’ve accrued through your mortgage.

Before you decide to refinance, think back to when you purchased your home.

- Did you pay points to get a lower rate?

- Has it been long enough that you’ve made your money back?

- Is there a pre-payment penalty on your loan?

- What is the purpose of this refinance?

Refinances EMPOWER you to change

the terms of your original mortgage!

All of these factors are important to consider when you’re weighing if you should refinance your home. Give us a call at 952-405-2090 to set up your FREE initial consultation. We can help you determine if now is the right time for you to refinance.

Are you ready to resolve your refi questions?

Refinance: refinance

verb

re·fi·nance | \ ˌrē-fə-ˈnan(t)s , (ˌ)rē-ˈfī-ˌnan(t)s, ˌrē-(ˌ)fī-ˈnan(t)s \

refinanced; refinancing; refinances

Definition of refinance

: to renew or reorganize the financing of something : to provide for (an outstanding indebtedness) by making or obtaining another loan or a larger loan on fresh terms refinance a mortgage